The New Black Ledger: Carbon isn’t Compliance Anymore, it’s Becoming Creativity.

Linda Hendricks operates where growth meets culture. A Franco-American Growth…

It always starts with a ledger. Wall Street had balance sheets, Silicon Valley had user counts, and fashion has always had mood boards. But now, there is a new column to reconcile: carbon. What once lived as invisible exhaust is becoming the most visible line on luxury’s balance sheet. At COP-30, the atmosphere itself is a stakeholder, and suddenly couture must be as fluent in CO₂ as it is in chiffon.

And here is the twist: carbon is not compliance, it is creativity. In a world where materials can absorb pollution like they once shimmered with sequins, and credits trade hands like Birkin bags, the brands that thrive will not be the ones doing less harm. They will be the ones turning harm into beauty. Carbon has become fashion’s new black, not just the color, but the ledger every maison must now design against.

1. “Haute Carbon: When Your Dress Breathes More Than You Do”

It is no longer enough for a dress to dazzle; it must detoxify. In the age of Haute Carbon, the runway is not just a showcase of silhouettes; it is a stage for climate innovation. Imagine a gown that does not just shimmer under spotlights but actively absorbs CO₂ as you move. A trench coat that mimics the carbon-sequestering power of a forest in motion. This is fashion reimagined, not as ornament, but as organism.

According to Bain & Company’s 2025 sustainability report, 60% of fashion brands are piloting AI-driven forecasting tools to reduce overproduction and optimize inventory. It is a sign that the industry is shifting from intuition to intelligence. Overproduction has long been fashion’s silent pollutant, and now AI is the scalpel cutting through excess. But the next frontier is not just smarter supply chains; it is garments that clean the air.

Enter carbon-positive fashion. Startups like Carbon Clean and Air-Ink are developing materials that capture emissions and repurpose them. Designers are experimenting with CO₂-absorbing yarns, solar-reactive dyes, and modular garments that adapt to climate conditions. Dezeen recently spotlighted carbon-capturing architectural films; imagine that tech woven into your next Balenciaga bomber.

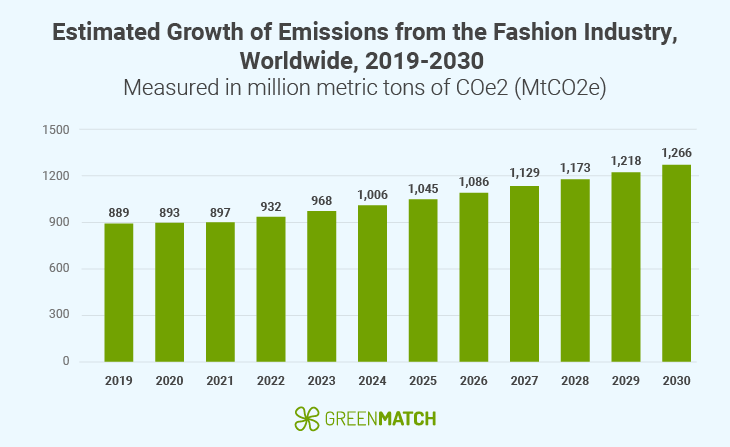

Data Source : GreenMatch

McKinsey’s “State of Fashion 2024” report underscores the urgency: fashion contributes up to 8% of global emissions. Governments are responding. The EU’s proposed Ecodesign for Sustainable Products Regulation (ESPR) will require brands to disclose environmental impact at the product level, making carbon a visible metric, not a hidden cost.

Luxury, with its high margins and cultural influence, is uniquely positioned to lead. As Bain notes, durability and lower impact per wear are already embedded in luxury’s DNA. But the new flex is not longevity, it is regeneration. Picture a Chanel jacket with the carbon value of a hectare of mangrove. Or a Hermès scarf that doubles as a verified carbon credit.

And the consumer? They are not just ready, they are demanding it. Gen Z and millennial shoppers want traceability, transparency, and transformation. They do not just want to wear fashion; they want to breathe through it. The brands that will thrive are not those doing less harm; they are the ones designing beauty from and for impact.

2. “The Credit of Beauty: Why Carbon Is Fashion’s New Currency”

Carbon offsets were once the backstage pass to sustainability, quietly purchased, vaguely verified, and rarely questioned. But the curtain has lifted. Investigations by outlets like The Guardian and Bloomberg Green have exposed the shaky scaffolding behind many forest-based offset schemes, revealing that up to 90% of rainforest credits issued by Verra may have overstated their impact. What was marketed as “carbon neutral” now risks being seen as “carbon negligent.”

Luxury, however, has never been content with ambiguity. In a sector where provenance is everything, the next evolution is carbon with a certificate of authenticity. Enter blockchain. The AURA Blockchain Consortium, backed by LVMH and others, is already using decentralized ledgers to track the origin of luxury goods. Now, imagine that same infrastructure applied to carbon: “Carbon Royalty” tokens linked to rainforest conservation, blockchain-verified credits tied to garment sales, or carbon shares embedded in limited editions. Consumers would not just own objects; they would own carbon stories.

The appetite is real. According to Bain, traceability and environmental impact are now top purchase drivers for Gen Z and millennial consumers, with 70% saying they would pay a premium for verified sustainable goods. Meanwhile, Deloitte’s 2024 Global Fashion & Apparel Study found that brands using digital traceability tools saw a 20% increase in consumer trust metrics.

Early adopters are already sketching the blueprint. Vestiaire Collective and The RealReal link resale to avoided emissions. Kering publishes an Environmental Profit & Loss (EP&L) statement that translates impact into financial terms. Reformation’s RefScale prints CO₂ savings directly onto garment tags. These are bold moves, but still fragmented, technical, and often invisible to the consumer eye.

Luxury thrives on alchemy, turning scarcity into desire. The next frontier is turning carbon into equity. Imagine a limited-edition Loewe jacket embedded with a digital twin that proves it funded rainforest protection. These might not be just accessories anymore; they might become assets.

And the consumer? They are no longer passive buyers. They are investors in impact. As Everledger notes, digital provenance is becoming the new luxury standard. The challenge now is to make carbon not just credible, but covetable.

3. “Carbon Runway: Fashion Weeks Without the Miles”

For decades, fashion’s most glamorous moments have been measured in miles. From Paris to Milan, New York to Tokyo, the industry’s calendar has been a choreography of flights, freight, and flashbulbs. But beneath the glitz lies a carbon footprint that rivals entire sectors. According to McKinsey & Global Fashion Agenda, fashion emits 1.2 billion tonnes of CO₂e annually, more than international aviation and maritime shipping combined. And while supply chains are slowly greening, the travel economy of fashion remains stubbornly carbon-heavy.

Air freight, for instance, emits ~60× more CO₂ per tonne-kilometre than sea shipping, according to Our World in Data. Influencer trips, brand activations, and fashion-week logistics often rely on last-minute flights and expedited shipping, choices that amplify emissions for the sake of speed. Transportation is the unseen thread that weaves through a garment’s carbon story, and fast fashion’s reliance on air freight is a major culprit.

Luxury, however, has the means and the mandate to rewrite this narrative. It is not just where we show, but how we move. Carbon calculators now allow brands to track emissions across every stage of the supply chain, including travel and logistics. This data is not just for compliance; it is for storytelling. A carbon-smart itinerary becomes part of the brand’s identity, a visible commitment to climate-conscious luxury.

And the consumer? They are watching. Seventy-two percent of Gen Z consumers expect brands to actively reduce travel-related emissions, especially in marketing and events. The message is clear: sustainability is not just about product; it is about performance.

The opportunity is ripe for luxury to lead. By turning mobility into a carbon-positive experience, brands can transform the runway from a climate liability into a climate asset. Because in the age of Haute Carbon, even the journey must be as elegant, and ethical, as the destination.

4. “Luxury Is in the Air: Designing Desire Out of Carbon”

Luxury has always sold desire, not necessity. But in the age of climate reckoning, the question is no longer “what looks or feels good?” but “what regenerates, for what or whom is it caring?” And suddenly, carbon is not just a constraint; it is couture’s new canvas.

Designers and architects are already sketching this future. Made of Air, a German startup, has developed a carbon-negative bioplastic made from biochar, used to clad a car dealership in Munich, storing 14 tonnes of CO₂ in its façade. Meanwhile, Biohm, a London-based startup, grows mycelium insulation that sequesters 16 tonnes of carbon per month as it feeds on agricultural waste. These are not just materials; they are statements.

In fashion, H&M has explored accessories made from AirCarbon™, a biomaterial derived from captured greenhouse gases. Swiss sportswear brand On launched garments made from CleanCloud, a polyester produced by LanzaTech using industrial CO₂ emissions. These innovations show how carbon can be transformed from waste into wearable luxury.

Luxury Tribune highlights how carbon-capture technologies offer dual benefits: they replace virgin fossil inputs and reduce atmospheric emissions. As the fashion industry seeks alternatives to synthetic fibers, which make up 64% of all textiles, carbon-based materials offer a path to circularity.

Synthiesis, the algae-printed “living footwear” by Brooklyn designer Jessica Thies, was developed as part of her master’s thesis at Parsons School of Design. Synthiesis is not just a shoe; it is a breathing organism. Printed with bio-ink infused with living microalgae, the sneaker photosynthesizes, absorbing carbon dioxide from the atmosphere as it is worn. The hemp-based fabric forms a smocked texture that supports the algae’s growth, while the soles, currently polyurethane, are envisioned to evolve into biodegradable, bio-based alternatives.

Synthiesis……The Process : Image Source : Jessica Thies

But Thies is not just designing for sustainability; she is designing for symbiosis. The shoes require care, like houseplants: nutrients, light, and oxygen to keep the algae alive. Without maintenance, the chlorophyll fades, signaling the shoe’s metabolic decline. It is a poetic provocation: what if our garments had lifespans, moods, and needs? What if fashion demanded nurture, not just wear?

Thies proposes a future where consumers become custodians, not just owners. Her work raises ethical questions about engineered living materials: how do we care for objects that live? What rituals emerge when our shoes breathe back? And what happens when they die?

And the consumer? They are craving meaning. Bain’s 2025 luxury report found that 72% of Gen Z buyers want brands to reflect their values, not just their style. Carbon design is not just functional; it is emotional. It is the new language of luxury.

Interview — Paula Menéndez (Oly)

In a world where luxury still treats resale like the awkward cousin at the family dinner, Paula Menéndez is quietly sketching the blueprint that could turn secondhand into fashion’s next growth engine. An HEC Paris and UC Berkeley alumna, she is an engineer by training and a founder twice over. She is behind Oly, a platform that does not sell clothes, but rather the efficiency to move them smarter, faster, cleaner. Oly’s magic is deceptively simple: data discipline in a market that has thrived on chaos. Instead of sellers manually juggling Vestiaire Collective, Joli Closet, Rebelle, and the rest, Oly lets them push a button and publish everywhere at once. Hours of grunt work vanish. Inventory looks fresher, leaner, sharper. Buyers see order where there used to be digital clutter.

Paula Menéndez in conversation ; Image Source: Press Office

But Paula is not just tinkering with workflows; she is rewriting the operating system of resale. Every synchronized upload, every buyer click, every pair of pumps that changes hands is more than a transaction; it is data. Data that maps demand curves as precisely as first-hand sales. Data that could turn secondhand into the carbon champion it dreams of becoming: not just euros saved, but emissions avoided, production delayed, waste deferred. In Paula’s hands, resale is no longer a side hustle. It is a carbon ledger in real time.

And here is the catch: the resale market is exploding, racing toward $367 billion globally by 2029 (ThredUp). But growth without order is collapse. Without connective tissue, resale risks drowning in its own fragmentation. Oly is that tissue, the unseen pipes turning scattered sellers into a single, scalable channel. If fashion’s future is to be lower-carbon, resale is not just nice to have; it is existential. And to scale, it must be smarter. Oly might not be a household name yet, but its ambition to fuse automation, data, and circularity makes it one of those quiet disruptors you only notice in hindsight. The kind that change how luxury calculates value: not just in ownership, but in carbon.

LH: You come from telecom engineering and entrepreneurship. How has that background shaped the way you harness data and precision thinking to build Oly?

PM: In telecom engineering I studied the whole history of communication systems, from Morse code to assembly languages to Python and modern software stacks. That gave me a deep appreciation for how societies build universal languages to transmit information. When I started thinking about resale, I realized we needed something very similar: a universal way to translate product data from one marketplace to another. That is where my systems mindset comes from, designing deterministic pipelines that turn messy seller inputs into clean, reliable outputs. I also carry an obsession with latency and reliability: in secondhand, every product is unique, so a failed upload is not just a bug, it is lost revenue. For me, Oly is about applying that engineering discipline to the new frontier of the circular economy.

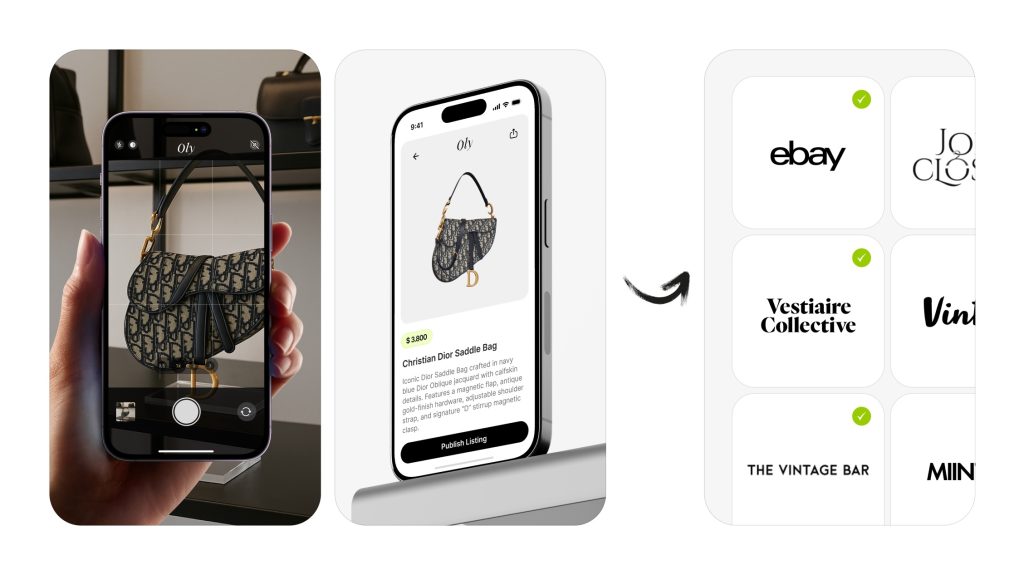

Oly The Platform ; Image Source : Press Office

LH: You have already partnered with eBay and Vestiaire Collective. What specific pain points are you solving for luxury resale? And what KPIs do you track to prove that resale, even with one-of-a-kind products, can truly scale?

PM: In luxury resale, the pain is in the details. Buyers search for very specific attributes: jewelry serial numbers, watch references, handbag models, even the exact color of metal hardware. Yet sellers often do not know, forget, or do not have time to add these details. That creates friction, lowers visibility, and blocks conversions. Oly solves this by constantly testing and iterating on which attributes matter most, enriching listings with the data that drives search and trust. We work directly with sellers and partner platforms to make sure the catalog is not only complete, but optimized for conversion and discoverability.

The KPIs we track are directly tied to scale: listing success rate, mapping accuracy, time-to-list, and ultimately seller ROI—how much incremental GMV they generate through Oly compared to the manual baseline. These are the proof points that even one-of-a-kind products can be scaled efficiently and reliably.

LH: Luxury often frames resale as a “carbon footprint champion.” From your vantage point, what do brands gain beyond revenue, whether it is data, brand equity, or carbon accounting? And what does Oly gain in return?

PM: For me, the most powerful moment for brands is the take-back. Managing that touchpoint well builds loyalty and can even drive in-store traffic if collection points are physical. Beyond revenue, resale unlocks data on product use, resale velocity, and condition—insights that can shape repair, upcycling, and material innovation.

On the carbon side, Vestiaire Collective has already started issuing credits linked to avoided first-hand production. That is a creative way of signaling that part of your revenue is not just neutral, but actively displacing emissions. I see real potential for brands to embrace resale not only as a commercial lever, but as a carbon value proposition.

Oly’s role is to make this seamless. We provide the infrastructure that enables brands to run and scale take-back and resale programs, while giving them the data to turn resale into both a commercial lever and a carbon value proposition.

How Oly Works ; Image Source : Press Office

LH: Your company automates resale through AI. How do you see digital tools like Oly not just reducing waste, but actively turning “carbon cost” into “carbon value”?

PM: truly believe people are good, but they also default to the path of least effort. If it is easier to buy a low-quality item first-hand, that is what they will do. Oly’s mission is to flip that equation, to make secondhand more abundant, more accessible, and ultimately more convenient than buying new.

We do that by making resale effortless: a seller takes a few photos, Oly digitizes and distributes the item across the right channels, and a buyer who is already searching can find it instantly. That simplicity turns resale from a hassle into the obvious choice.

From a carbon perspective, every time an item is resold, the cost of producing it is amortized across multiple owners. Instead of a one-to-two-year lifespan, we can extend it three, four years or more. That transforms carbon from a sunk cost into a shared value. Every resale transaction defers new production, reduces waste, and increases the utility of what already exists.

LH: Carbon credits and ESG metrics are under scrutiny. Do you see resale platforms like Oly helping rebuild trust by making carbon savings verifiable and traceable at the transaction level?

PM: As Oly grows, I see us being well positioned to add another layer of traceability around clothing use. By capturing the purchase date when an item is listed, either through direct brand integrations or from sellers themselves, we could measure not just the avoided impact of resale, but the full lifespan of each garment. That would give buyers, brands, and marketplaces unprecedented transparency into the true carbon footprint of fashion.

LH: Looking ahead five years, what do you foresee at the intersection of sustainability, data, and luxury innovation, and what role could Oly play in shaping that future?

PM: I foresee luxury brands positioning themselves as allies to their customers in being more sustainable. Even for buyers who do not typically shop secondhand, brands can build take-back programs that allow customers to responsibly part with items when they are ready, reinforcing loyalty and sustainability. At Oly, we see ourselves as the partner helping luxury houses power these programs, enabling them to re-engage with their most valuable clients, anticipate when an item’s lifecycle is ending, and position themselves as leaders in sustainable luxury. Beyond take-back, transparency on sourcing and supply chains will become central, as buyers increasingly choose brands not just for style, but for values and legacy.

What's Your Reaction?

Linda Hendricks operates where growth meets culture. A Franco-American Growth Strategy and Digital Transformation leader, she has spent over 15 years helping brands, from emerging designers to Fortune 500 navigate expansion at the intersection of marketing, media, technology and culture across the U.S. and Europe. Currently Growth Director at Havas Media, she builds strategic partnerships and AI-enabled growth pathways, connecting market signals, internal capabilities, and ambition into coherent, scalable opportunities. Her work spans luxury, fashion, media, and consumer ecosystems, with a focus on product-led platforms, omnichannel growth, and commercially grounded innovation. Linda is drawn to moments where business models shift, narratives matter, and conscious growth must remain culturally credible to endure.